It's about time for my yearly review of ING Direct's Streetwise mutual funds. So after the stock market turbulence of 2007 to 2009, the last three years has seen fairly steady gains. The ING Streetwise funds suffered in 2008 with large falls, but their recent performance is a source of hope.

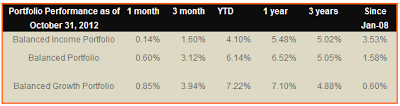

Here's the most recent 2012 performance figures for the Streetwise Balanced Income, Balanced Portfolio and Balanced Growth Portfolio (taken direct from ING Direct Canda's website).

All funds have seen healthy gains over the year to date, with the Balanced Growth Portfolio clocking in at just over 12%.

Of course, the Streetwise funds were launched during the market turbulence of 2008, so the growth since launch has been rather anemic, to say the least. However, since I dollar-cost average into the Balanced Growth fund every month since launch, I managed to buy some initial units at a cheap price, so I'm looking at a larger gain.

Here are one-year performance benchmarks for the Streetwise Funds.

The Sharpe Ratio for the Streetwise Balanced Income fund over the last year is a healthy 2.33 (respectable in anyone's eyes). The Sharpe Ratios for the other two funds are lower at just over one (still not bad). However, the modestly good Sharpe Ratios masks rather poor mean annual returns for all three funds.

The

alpha for all three funds are negative, indicating that they have under-performed their benchmark. The

beta for the three funds are around 0.9 - 1. This indicates that their volatility matches that of their benchmark, or is slightly lower.

I'm not overly impressed by the performance figures. But I'm a buy-and-hold kind of guy. I'll maintain my monthly investment plan inside a TFSA in the Streetwise Balanced Growth fund.

ING Direct Canada still have a referral reward system. If you use the Orange Key 40014077S1 when you open any account (with an initial $100 deposit by cheque), you'll get a $25 bonus (or $50 before the end of 2012).

You'll also get your own Orange Key so you can get your own referrals! Magic!